Write steps to calculate total tax payable by the individuals at the following rate showing income tax, surcharge and total tax in column C, D & E respectively:Surcharge is to be calculated at 10% on the income tax only if the Income exceeds Rs.5 lakhs. (Excel-2007)

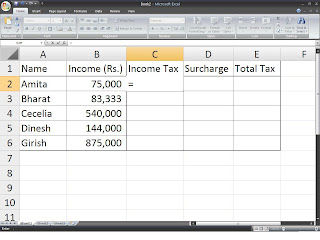

The following data has been entered in a Excel worksheet

Write steps to calculate total tax payable by the individuals at the following rate showing income tax, surcharge and total tax in column C, D & E respectively:

Income | Tax Rate |

First Rs.50,00 | 0% |

Next Rs.10,000 | 10% |

Next Rs.90,000 | 20% |

Excess | 30% |

Surcharge is to be calculated at 10% on the income tax only if the Income exceeds Rs.5 lakhs.

To compute income tax in column C.

Enter the formula,

=IF(B2<=50000,0,IF(B2<=60000,(B2-50000)*.1,IF(B2<=150000,1000+ (B2-60000)*.2, 19000+(B2-150000)*.3)))

in cell C2 and then press enter key, using the fill handle of cell C2, copy the formula to cells C3 :C6 by dragging the fill handle

To compute SURCHARGE in column D.

Enter the formula,

=IF(B2>500000,C2*10%,0) in cell D2 and then press enter key,

using the fill handle of cell D2, copy the formula to cells D3 :D6 by dragging the fill handle up to cell D6 .

To compute TOTAL in column E.

Enter the formula,

=C2+D2 in cell E2 and then press enter key,

using the fill handle of cell E2, copy the formula to cells E3 :E6 by dragging the fill handle up to cell E6 .

0 comments:

Post a Comment